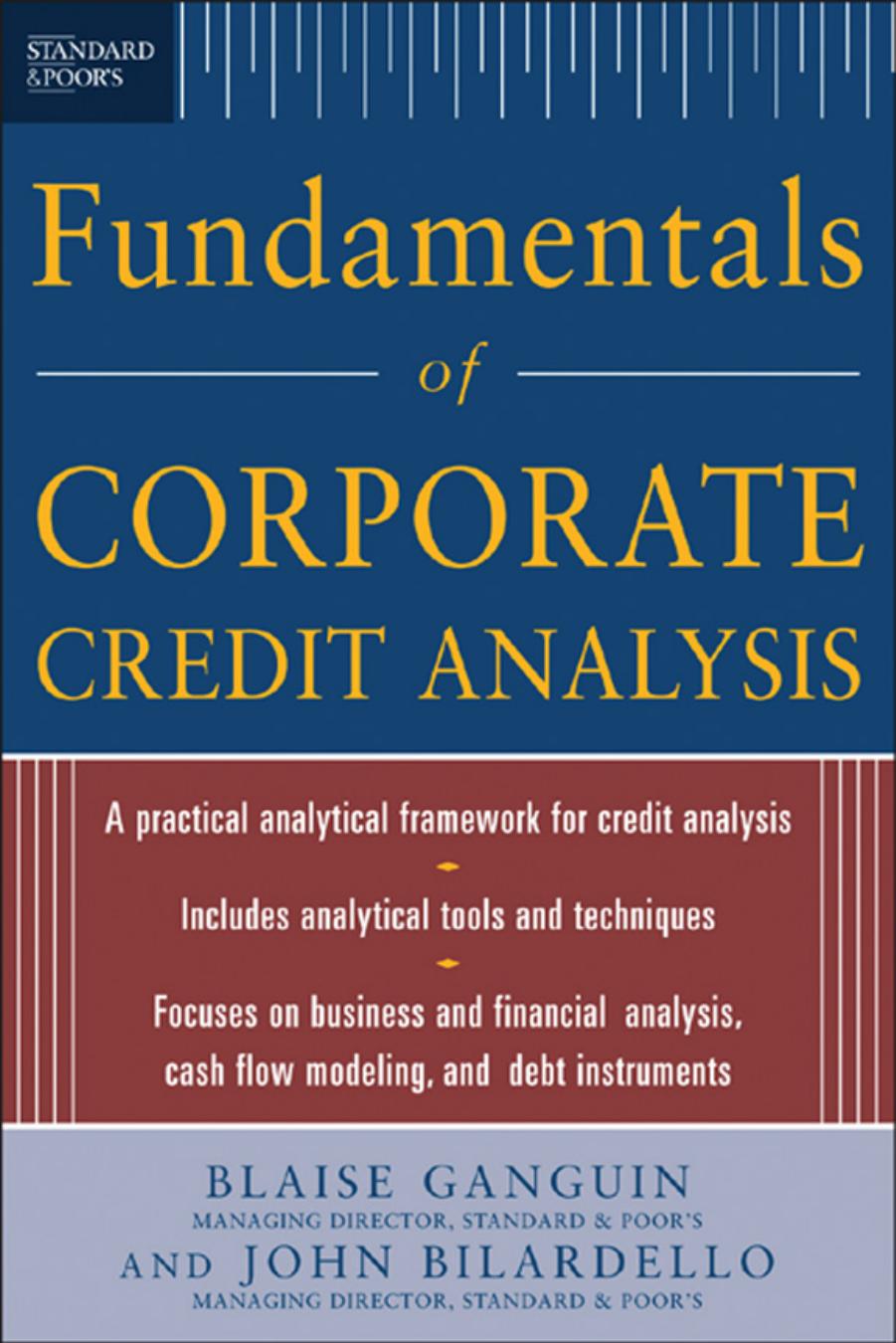

Standard And Poor’s Fundamentals of Corporate Credit Analysis 1st edition by Blaise Ganguin, John Bilardello ISBN 1265917582 978-1265917586

$70.00 Original price was: $70.00.$35.00Current price is: $35.00.

Instant download Standard And Poor’s Fundamentals of Corporate Credit Analysis Blaise Ganguin John Bilardello after payment

Standard And Poor’s Fundamentals of Corporate Credit Analysis 1st edition by Blaise Ganguin, John Bilardello- Ebook PDF Instant Download/Delivery: 1265917582, 978-1265917586

Full download Standard And Poor’s Fundamentals of Corporate Credit Analysis 1st edition after payment

Product details:

ISBN 10: 1265917582

ISBN 13: 978-1265917586

Author: Blaise Ganguin, John Bilardello

An up-to-date, accurate framework for credit analysis and decision making, from the experts at Standard & Poor’s

“In a world of increasing financial complexity and shorter time frames in which to assess the wealth or dearth of information, this book provides an invaluable and easily accessible guide of critical building blocks of credit analysis to all credit professionals.”

–Apea Koranteng, Global Head, Structured Capital Markets, ABN AMRO

“The authors do a fine job of combining latest credit risk management theory and techniques with real-life examples and practical application. Whether a seasoned credit expert or a new student of credit, this is a must read book . . . a critical part of anyone’s risk management library.”

–Mark T. Williams, Boston University, Finance and Economics Department

In a dynamic corporate environment, credit analysts cannot rely solely on financial statistical analysis, credit prediction models, or bond and stock price movements. Instead, a corporate credit analysis must supply loan providers and investors with more information and detail than ever before. On top of its traditional objective of assessing a firm’s capacity and willingness to pay its financial obligations in a timely manner, a worthy credit analysis is now expected to assess recovery prospects of specific financial obligations should a firm become insolvent.

Standard And Poor’s Fundamentals of Corporate Credit Analysis 1st Table of contents:

Part I: Corporate Credit Risk

Chapter 1. Sovereign and Country Risks

Chapter 2. Industry Risks

Chapter 3. Company-Specific Business Risks

Chapter 4. The Management Factor

Chapter 5. Financial Risk Analysis

Chapter 6. Cash Flow Forecasting and Modeling

Part II: Credit Risk of Debt Instruments

Chapter 7. Debt Instruments and Documentation

Chapter 8. Insolvency Regimes and Debt Structures

Chapter 9. Estimating Recovery Prospects

Part III: Measuring Credit Risk

Chapter 10. Putting It All Together: Credit Ranking

Chapter 11. Measuring Credit Risk: Pricing and Credit Risk Management

Part IV: Appendices A To G: Cases in Credit Analysis

Appendix A: AT&T Comcast

Appendix B: The MGM/Mirage Merger

Appendix C: Kellogg’s Acquisition of Keebler

Appendix D: Repsol/YPF

Appendix E: Air New Zealand

Appendix F: Peer Comparison: The Three Largest U.S. Forest Products Companies

Appendix G: Yell Group Ltd. Leveraged Buyout (LBO)

People also search for Standard And Poor’s Fundamentals of Corporate Credit Analysis 1st :

standard and poor’s fundamentals of corporate credit analysis pdf

what does standard and poor’s do

standard and poor’s

standard and poor’s us rating

standard and poor’s guide to money and investing

Tags: Blaise Ganguin, John Bilardello, Poor’s Fundamentals, Credit Analysis